Chance News 63

Quotations

Everyone is entitled to his own opinions, but not his own facts.

Daniel Patrick Moynihan

As quoted in Believing Weird Things is Dangerous, Rob Breakenridge, The Calgary Herald, April 13, 2010.

Submitted by Steve Simon

It’s like buying fire insurance on your neighbor’s house — you create an incentive to burn down the house.

Philip Gisdakis, head of credit strategy at UniCredit in Munich

Quoted in the context of the Greek credit crisis (Banks bet Greece defaults on debt they helped hide, New York Times, 24 February 2010). But suddenly relevant again in light of recent SEC allegations against Goldman Sachs.

Submitted by Bill Peterson

Forsooth

A survey released by researchers at George Mason University found that more than a quarter of television weathercasters agree with the statement “Global warming is a scam,” and nearly two-thirds believe that, if warming is occurring, it is caused “mostly by natural changes.” (The survey also found that more than eighty per cent of weathercasters don’t trust “mainstream news media sources,” though they are presumably included in this category.)

Elizabeth Kolbert, The New Yorker

April 12, 2010

Submitted by Margaret Cibes

HIV patients in low socio-eonomic classes are 89 per cent more likely to die than better-off people with the infection, claims a study of 2684 adults in the Journal of Health Care for the Poor and Underserved (Nov).

The Times

8 November 2005

There are now more overweight people in America than average-weight people. So overweight people are now average. Which means you've met your New Year's resolution.

Jay Leno reported in the Cork Evening Echo

8 September 2007

The following 2 forsooths are from the April 2010 RRS News

British experts studied more than 17,000 children born in 1970

for about four decades. Of the children who ate candies or chocolates

daily at age 10, 69 percent were later arrested for a violent offence by the age of 34.

Of those who didn't have any violent clashes, 42 per cent ate sweets daily.

Northern Territory News

2 October 2009

A separate opinion poll yesterday suggested that 50% of

obese people earn less than the national average income..

The Guardian

3 November 2009

Submitted by Laurie Snell

From an interview with a con man who claims he can provide a stem-cell cure for diseases such as ALS and Alzeimer's:

Interviewer: “You told these men in Houston that a cure was, in a memorable phrase, 100% possible.”

Con man: “Possible. Is that a guarantee?”

60 Minutes, CBS

April 18, 2010

Submitted by Margaret Cibes

Of the 29,000 people who may get cancer from CT scans done in 2007, about 50 percent will die, the researchers estimated.

Nicole Ostrow, Bloomberg.com

December 14, 2009

Submitted by Margaret Cibes

Tiger’s effect on opponents

“Superstar Effect”

by Jonah Lehrer, The Wall Street Journal, April 3, 2010

Lehrer, author of How We Decide[1], states:

While challenging competitions are supposed to bring out our best, … studies demonstrate that when people are forced to compete against a peer who seems far superior, they often don't rise to the challenge. Instead, they give up.

The article is based, for the most part, on the paper “Quitters Never Win: The (Adverse) Incentive Effects of Competing with Superstars”, by Jennifer Brown, Northwestern University, September 2008. The paper includes detailed descriptive and inferential statistics.

Brown chose to study golf mainly because of the presence of Tiger Woods, whose playing dominates the game. She looked at data from professional golfers and found that the presence of Tiger Woods in a tournament resulted in the other golfers, taking, on average, 0.2 more strokes in the initial 18 holes and 0.8 more strokes in the whole tournament. (Note that Lehrer cites the figure 0.3 instead of Brown’s figure, 0.2.)[2]

Brown’s results apply to a field called economic tournament theory that investigates competitions in which relative, instead of absolute, performance is rewarded. She feels that the superstar effect is strongest when “there is a nonlinear incentive structure,” that is, when there is an extra incentive to finish first.

Lehrer also refers to a 2009 study[3] by University of Chicago psychologist Sian Beilock, who examined “choking” during golf competitions, possibly due to golfers over-thinking their actions.

We bring expert golfers into our lab, we tell them to pay attention to a particular part of their swing, and they just screw up. …When you are at a high level, your skills become somewhat automated. You don't need to pay attention to every step in what you're doing. ….

Lehrer concludes:

Regardless of the precise explanation for the superstar effect—are golfers quitting on themselves or thinking too much?

A blogger commented[4]:

But even the best do not intimidate every opponent. Ali did not intimidate Frazier, Federer did not intimidate Nadal (in fact it was the other way around until Nadal was weakened by injuries). Even Michael Jordan wasn't intimidating when he played without Scottie Pippen.

Submitted by Margaret Cibes

Dribbling data

"At the Free-Throw Line, 1...2...3...4 Whoosh"

by David Biderman, The Wall Street Journal, April 3, 2010

The author reports that, of the 425 free-throw attempts in the past 10 NCAA title games, players who dribbled 1, 2, 3, or 5 or more times before shooting were successful 60%, 66%, 68%, and 68% of the time, respectively, while those who dribbled 4 times were successful 77% of the time. Also, there were more NBA all-stars in the 4-dribble group than in any other group.

Submitted by Margaret Cibes

Discussion

1. Buried in the article: The total sample size of free throws attempted was 425, with 60, 121, 191, 22 and 9 representing 1, 2, 3, 4 and 7 dribbles for a total of 403. No information is given for 5 and 6 dribbles but from the data, the inference is that the represent 22 (425-403) attempts. Given this data, how impressive does the 77% success rate for four dribbles appear?

2. Why didn’t the author choose to present a simple table of number of dribbles, free-throw attempts, free-throws made instead of dribbling the information all over the article? Is any insight provided by the following graphic from the article?

http://sg.wsj.net/public/resources/images/PT-AO308_COUNT_NS_20100402163830.gif

3. The headline in the print edition, but not in the online edition is, "At the Foul Line, Four is the Magic Number." Comment on the "magicness" of four given the actual data.

Submitted by Paul Alper

Bird brains vs. birdbrains

“Mathematicians vs. Birds vs. Monty Hall”

by Tom Bartlett, The Chronicle of Higher Education, March 17, 2010

“Pigeons Beat Humans at Solving ‘Monty Hall’ Problem”

by Charles Q. Choi, Live Science, March 3, 2010

In the February 2010 issue of the Journal of Comparative Psychology, two Whitman College researchers reported about their work comparing the success rates of 6 pigeons and 12 undergraduate student volunteers in solving the Monty Hall problem[5] by trial and error:

By day 30 of the experiment, the pigeons had “learned” to adopt the best, “switch,” strategy “96 percent of the time.” However, the students had not found the best strategy “even after 200 trials of practice each.”

See an abstract[6] of the paper “Are birds smarter than mathematicians?”

Submitted by Margaret Cibes, based on an ISOSTAT posting

Odds are, it's wrong

Odds are, it's wrong

by Tom Siegfried, Science News, 27 March 2010

An essay on the limitations of significance testing. To be continued...

Submitted by Bill Peterson, based on a suggestion from Scott Pardee

Global data graphics

“Hans Rosling shows the best stats you’ve ever seen”

TEDTalk, February 2006

Hans Rosling[7] is global health professor and co-founder of Doctors without Borders Sweden, as well as a very entertaining speaker.

In this 20-minute YouTube video, he addresses “common myths about the so-called developing world,” based on animated graphs of UN data over time. Viewers will see “moving bubbles and flowing curves that make global trends clear, intuitive and even playful,” thanks to the free visualization software he has developed. (Full screen view is recommended.)

See also Rosling’s website, Gapminder[8], for lots more information and data.

Submitted by Margaret Cibes, based on an ISOSTAT posting

Optimism of financial analysts

“Dow Loses Points, but Reader Wins 10-Year-Old Bet”

The Atlantic, May 2010

More than 10 years ago The Atlantic printed an article by the co-authors of a “new” theory of stock valuation, which included a prediction that the DJIA would rise from 11,453 at the end of 1999 to about 36,000 by the end of 2009. A reader wrote the magazine, calling the theory “a giant fallacy” and betting the authors that the Dow would be closer to 11,000 in 10 years.

The two authors agreed to the following bet:

If the Dow is closer to 10,000 than to 36,000 ten years from now, we will each give $1,000 to the charity of your choice.

After the Dow closed at 10,428 on December 31, 2009, the co-authors each donated $1,000 to the Salvation Army, the letter writer’s charity of choice.

It’s been a bad run for optimists,” [a co-author] noted.

The letter writer stated:

I’m surprised at the way it turned out. I thought their theory was pretty extreme, and that was the point of my letter …. I never imagined the Dow would have been less than in 1999. In a way, I was probably just as wrong as [the co-authors] were. If someone had bet me it would be lower, I would have taken the bet and lost it. Everybody lost on that one.

Submitted by Margaret Cibes

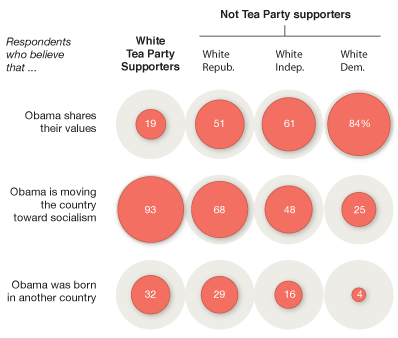

Tea party graphics

A mighty pale tea

by Charles M. Blow, New York Times, 16 April 2010

This article recounts Blow's experience visiting a Tea Party rally as a self-identified "infiltrator." He was interested in assessing the group's diversity. Reproduced below is a portion of a graphic, entitled The many shades of whites, that accompanied the article.

The data are from a recent NYT/CBS Poll.

Submitted by Paul Alper

Puzzles

Jessica Pittman is an education major doing an assistantship under a math teacher. She found Chance News very helpful but also noted that the link to a puzzle website referred to in Chance News 10.02 no longer exists. She suggests a similar website here as a replacement.

Submitted by Laurie Snell

NFL draft akin to coin toss

“A 50% Chance You’ll Squander Millions”

by Michael Salfino, The Wall Street Journal, April 21, 2010

According to an April 2010 Yale School of Management study, “The Loser’s Curse: Overconfidence vs. Market Efficiency in the National Football League Draft”,

[A]ny player called to the podium in the first five picks of the draft has about a 50% chance of being a flop.

Of the top five picks from 1991 through 2004, 10 (14%) did not play at least five years, 26 (37%) were/are still in the league after five years but never made a Pro Bowl, and 34 (49%) made at least one Pro Bowl.

The article contains an interactive graphic, “The Best NFL Prospects Pound-for-Pound”, in which the reader can choose one of five physical tests (40-year dash, bench press, broad jump, vertical jump, three-cone), and see the each draft pick’s performance on that test (as z-scores based on all 70 picks). Players are categorized by team position (5 defensive and 4 offensive positions).

Submitted by Margaret Cibes

NFL draft as simultaneous auction

“Why the NFL Draft Drives Economists Crazy”

by Reed Albergotti, The Wall Street Journal, April 22, 2010

Because the worst league teams get the first picks, it often “forces them to draft players they don't really need at prices they can't afford … [and m]any top picks hold out of training camp before they sign, only to end up with enormous contracts that have little to do with their true value to a football team.” One NFL executive is quoted:

"There's a huge trail littered with guys who got the big dollars but were a bust.

One problem with the current 75-year-old system is that the college game has changed significantly from a professional game. Another is that it is difficult to evaluate a player’s worth on the open market.

A team of WSJ and Harvard researchers have proposed using a “simultaneous ascending auction[, which] involves every NFL team bidding on all college players at the same time.” See

“Redrafting the Draft”, an interactive graphic that shows a mock auction detailing how the bottom-ranked St. Louis Rams might fare in this system.

Three Harvard Business School researchers have proposed giving each of the 32 teams seven picks, with spending caps on a sliding scale, in which the worst team would have the highest spending cap. Teams could raise their bids in competition for the most desirable picks, but that would have to be done within their spending caps.

Chances are

Chances are

by Steven Strogatz, New York Times, Opinionator blog, 25 April 2010

Steven Strogatz, an applied mathematics professor at Cornell, has been writing weekly installments about mathematics for the Opinionator. This week's entry is about probability. (To be continued...)

Submitted by Bill Peterson, based on a suggestion from Dan Bent (an intro statistics student)

Submitted by Margaret Cibes