Chance News (September-October 2005)

Do car seats really work?

Freakonomics: the seat-belt solution

New York Times, 10 July 2005,

Steven J. Dubner and Steven D. Levitt

Dubner and Levitt are the authors of Freakonomics: A Rogue Economist Explains the Hidden Side of Everything (HarperCollins, 2005), which raises a host of provocative questions, including "Why do drug dealers still live with their mothers?" and "What do schoolteachers and sumo wrestlers have in common?"

In the present article, Dubner and Levitt challenge the conventional wisdom on car seats. Their take-no-prisoners style is evident in the following quote: "They [car seats] certainly have the hallmarks of an effective piece of safety equipment: big and bulky, federally regulated, hard to install and expensive. (You can easily spend $200 on a car seat).” Indeed, regarding the third point, the National Highway Traffic Safety Administration (NHTSA) estimates that 80 percent of car seats are not installed correctly.

What then are the benefits? Here the authors cite another NHTSA statistic: “[Car seats] are 54 percent effective in reducing deaths for children ages 1 to 4 in passenger cars.” It turns out, however, that this compares riding in a car seat to riding with no restraint. Surely the relevant comparison, as suggested in the title of this article, is to riding with seat belts.

The authors concede that for children up to two years old, seat belts are not an option, so car seats logically offer some protection. But for children of ages 2 and older, federal Fatality Analysis Reporting System (FARS) data shows no decrease in overall death rate for children riding in cars seats compared with seat belts. Moreover, this conclusion does not change after controlling for obvious confounding variables such as vehicle size or number of vehicles involved in the accident.

But perhaps the potential benefit of car seats is being masked by the installation woes noted earlier. To check this, the article reports that Dubner and Levitt had an independent lab conduct crash tests, using both 3-year-old and 6-year-old dummies, to compare car seats to lap-and-shoulder seat belts. In 30 mile per hour crashes, the impact figures for 3-year-olds were “nominally higher” with seat belts; for 6-year-olds the figures were “virtually identical.” In addition, both restraint systems performed well enough against federal standards that no injuries would be expected.

Is there a housing bubble?

Be Warned: Mr. Bubble's Worried Again

The New York Times, August 21, 2005

David Leonhardt

Irrational Exuberance: Second Edition

Princeton University Press, 2005

Robert J. Shiller

According to the Times article, in December 1996 Shiller, while having lunch with Federal Reserve Chairman Alan Greenspan, asked Greenspan: "When was the last time that somebody in his job had warned the public that the stock market had become a bubble?"

The next day, while driving his son to school, Shiller heard on the radio that stocks were plunging because Greenspan had asked in a speech whether "irrational exuberance" was infecting the markets. Shiller told his wife, "I may have just started a worldwide stock-market crash." She accused him of delusions of grandeur.

Well, the fall did not start immediately but Shiller's book came out in April 2000, allowing the publisher to say that the market crash predicted in this book started one month after it was published. Needless to say, Shiller's book became a best seller.

Standard economic finance theory assumes that the stock market is "efficient," meaning that short-run changes in stostockck prices cannot be predicted which is interpreted to mean that stock market prices resemble a random walk. The most well-known proponent of this theory is Burton Malkiel whose book "A random walk down wall street" is in it's 6th edition. Malkiel has suggested that a monkey throwing darts could do as well as the most suffisticated stock advisors.

Shiller is one of the leaders in the new "Behavioral Finance" movement, which assumes that stock prices are are often influenced by irrational behavior of stock buyers which, in many cases, can be explained in terms of modern psychology theory.

His book explains how how irrational behavior leads to "speculative bubbles" defined as a situation in which temporarily high prices are sustained largely by investor's enthusiasm, rather than by consistent estimation of real value.

Here is a more detailed account of factors that Shiller though effected stopck prices from Jennifer Conrad's review in the Journal of Financial Research, April 1, 2001.

Part 1 of the book discusses the factors that might have contributed to, or amplified the size of, the bubble. These factors include changes in the institutional landscape (the rise in the use of mutual funds, the advent of day trading, the movement toward defined contribution pension plans), economic trends (the Internet), and broader societal factors (the collapse of communism, etc.) The discussion of "amplifying" factors in this section is essentially an argument about how a feedback loop may occur.

Part 2 discusses cultural factors that also could have contributed to the bubble (such as the news media and a shared error problem) and the propensity for "new age" thinking in the United States and elsewhere in the world. The author provides some historical examples of this last effect.

Part 3 discusses the possibility that psychological factors may influence the market.

Part 4 discusses the attempt by other authors to "rationalize" the stock market. This includes a discussion of the efficient market hypothesis, and the idea that there has been a paradigm shift, that is, that investors have learned that equities are not as risky as they previously appeared and have consequently bid up their prices.

At this point we recommend that you read the review of the first edition of this book that Charles Grinstead wrote for Chance News. You will note that his discussion question was: What do you think this reviewer did with his stocks after writing this review?

The correct answer to this question is: He took all his money out of stocks at a time that the Dow was near its highest point before the crash.

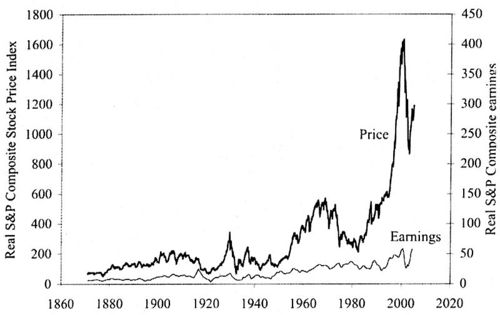

Much of what Shiller writes about is best shown by the elegrant graphics he provides. The following graphic which shows that the rise and fall of the stock market between 1990 and 2000 qualifies as a speculative bubble.

Real (inflation-corrected) S&P Composite Stock Price Index, monthly, January 1871 through January 2005 (upper curve), and real S&P Composite earnings (lower curve) January 1871 to September 2004.

In the preface of this second edition Shiller writes:

A number of people who read the book (first edition) have told me they think this book addressed a much broader subject. They are right: This book is really about the behavior of all speculative markets, about human vulnerability to error, and about the instabilities of the capitalist system.

If you review the factors that Shiller believes influences stock prices you will see that most of them could apply equally well to housing prices.

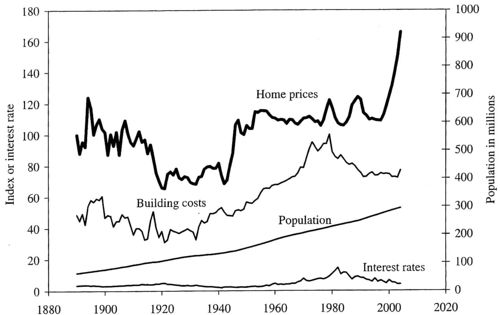

Shiller looked at housing prices back to 1890 and from his data obtained the following graphic:

Heavy solid line: real (inflation-corrected) home price index, 1890 = 100, for the United Sates; thin line: real building cost index, 1979 = 100; lowest line: long term interest rate.

A home price index acts like a stock index in that it starts with a house have a known value at a prescribed time and then indicates the value of this house at later times. Of course the best way to do this would be to like the stock market follow a specific house through time but this is not very practical. However Shiller with help by his students did this over an extended period.

The most striking thing we notice is the sharp increase in house prices since the 1990's. There was a 52% increase in housing prices between 1997 and 2004. Only one other similar increase occurred after World War II, which was probably caused by the fact that the GI Bill guaranteed loans for purchasing or building a home, or for repairs or improvements to existing homes. While it is a common believe that the price of a house can only go up we see that, taking into account inflation, we see from Shiller's data that there was only one period of time (after World War I) when prices have gone down and two periods of time when they have gone up. The rest of the time prices have been essentially flat.

Shiller also notes from his graphic that the "rocket taking off" of recent housing prices cannot be explained by increased building costs, increased population, or interest rates.

His analysis leads him to believe that it is very likely that we will see a speculative bubble in the not too distance time.

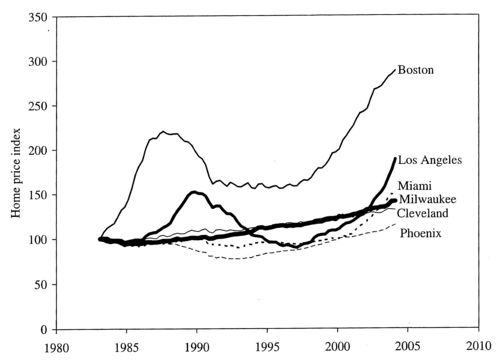

Shiller notes that evidence for this bubble does not occur in all cities. To show this, he looked at home prices in a sample of 6 major cities and found the following results:

One has to admire Shilling’s desire and ability to get his own data and the imaginative way that he does that. Also before guessing what makes people buy stocks and houses at particular times he has carried out surveys over many years to get peoples opinions on buying and selling stocks and houses.

Of course he is not the only one to do this and here are a couple more interesting graphics related to the housing market.

Here is a graphic that occurred in the article "Real Estate vulnerability Index" by Sara Clemenceon Forbes.com, June 3, 2005.

Economy.com calculated the affordability of real estate in major metropolitan areas, taking into account home sale prices, incomes and interest rates. The left side of the graph shows what percent of the median home a family earning the median income can buy. A higher number means housing is more affordable; a lower number means the average home is more out of reach.

At the "Real Estate vulnerability Index"you can see these cities individually. You will see that San Francisco, New York, and Los Angeles are currently at about 50, which means that the average home would typically be out of the range of to them. On the other hand Dallas, Atlanta and Houston are currently at about 200 making is easy for them to buy an average priced home. These seem consistent with Shillings house values but in the Forbes graphic Boston is at about 100 which seem inconsistent with the very high increase in the price of a house in Boston home found by Shilling.

Recall that Shiller's definition of a speculative bubble was a situation in which temporarily high prices are sustained largely by investor's enthusiasm, rather than by consistent estimation of real value.

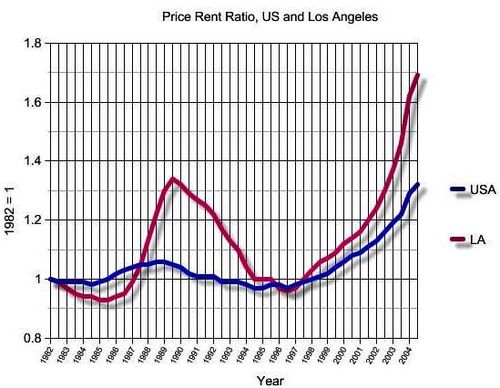

In the case of stocks the real value can be estimated from current and future pofits of the company. But what is it in the case of a house? One suggestion is that value of a house can be estimated by how much it would rent for. This suggests creating a price rental index. This can be done by using the price index of the Office of Federal Housing Enterrise Oversight (OFHEO) and the rental index developed by the Bureau of Labor as part of the consumer prince indexes. If these indexes are normalized to have value 1 and a specific time then the ratio of these normalized indicies indecates in future times if house prices are increasing faster or slower that rental prices giving some idea if it is cheaper to buy or rent a house.

We see from this graphic that prices are increasing much faster than rental's suggesting that renting is a better strategy the buying at this time. Note that there was a 1980 bubble in the LA.

Of course, if you are like my daughter Mary whod is renting and wanting to buy a house what advice would you give from all this? Here is how Shiller responded when asked what should we do in an [interview] with Monday Magazine:

Q. So what should we do?

A. Most people want to live in their homes, so they should stay. But people can make decisions to reduce their home-price exposure. One possibility is to not be as ambitious about the size of your house. If you think that you'll move again in five years, then wait to buy your dream house.

Q. What about homeowners who are sitting on big paper profits -- should they cash out?

A. I wouldn't advise someone to sell, because their family situation is probably the dominant consideration. But if someone is at the margin, the question is timing. That's the problem with bubbles: Nobody knows when they will end.

The first answer is a little confusing but it sound like Mary should continue to rent for a few more years.

The mystery to me in all this is the following. His explanation for what determines stock prices seems much more reasonable than Burton Malkiel puts forth in his famous "A Random Walk Down Wall Street" based on the assumption that stock prices are like random walks. This theory implies that we can't do better than the Dow does. But surely with all of Shiller's new insight it seems we should be able to. However, in a recent article

Just how reliable are scientific papers?

Scientific accuracy ...and statistics, The Economist, 3 September 2005.

Why Most Published Research Findings Are False

(pdf version), John P. A. Ioannidis

John Ioannidis, an epidemiologist, claims that 50% of scientific papers eventually turn out to be wrong.

While it is known that science is a Darwinian process, proceeding as much by refutation as by publication, no one has tried to quantify this issue until recently. The author sets out to understand how frequently highly cited studies are contradicted.

"There is increasing concern that, in modern research, false findings may be the majority or even the vast majority of published research claims," says Ioannidis in a related analysis, Most published research findings may be false, which appears in PLoS Medicine an open access, freely available international medical journal. (The Public Library of Science (PLoS), which publishes The PLoS Medicine is a non-profit organization of scientists and physicians committed to making the world's scientific and medical literature a freely available public resource.)

Ioannidis examined 49 articles which were cited at least 1,000 times in widely read medical journals between 1990 and 2003. But 14, about a third, were later refuted, such as hormone replacement therapy safety (it was, then it wasn't), vitamin E increasing coronary health (it did, then it didn't) and the effectiveness of stents in balloon angioplasty for coronary-artery disease (they are, but not as much as first claimed).

One source of error is unsophisticated reliance on "statistical significance," since twenty randomly chosen hypothesis are likely to result in one or more statistically significant results. In fields like genetics where thousands of possible hypothesis, genes that contribute to a particular disease, are examined, many (false) positive results will routinely occur purely by chance.

Other factors contribute to false results. One driving factor is sample size. "The smaller the studies conducted in a scientific field, the less likely the research findings are to be true," says Ioannidis. And another factor is effect size, such as drugs that work only on a small number of patients. Research findings are more likely to be true in scientific fields with large effects, such as the impact of smoking on cancer, than in scientific fields where postulated effects are small, such as genetic risk factors for diseases where many different genes are involved in causation. If the effect sizes are very small in a particular field, says Ioannidis, it is "likely to be plagued by almost ubiquitous false positive claims."

The author goes on to define a mathematical model to quantify sources of error. He concludes that a large, well-designed study with little researcher bias has only an 85% chance of being right. A small sample, poorly performing drug with researcher bias has only a 17% chance of reaching the right conclusions. And over half of all published research is probably wrong.

The author states his overall conclusions as follows:

- Contradiction and initially stronger effects are not unusual in highly cited research of clinical interventions and their outcomes. The extent to which high citations may provoke contradictions and vice versa needs more study. Controversies are most common with highly cited nonrandomized studies, but even the most highly cited randomized trials may be challenged and refuted over time, especially small ones.

In their related editorial, the PLoS Medicine editors discuss the implications of Ioannidis' analysis. They agree with him in some respects. They write, "publication of preliminary findings, negative studies, confirmations, and refutations is an essential part of getting closer to the truth." And the editors "encourage authors to discuss biases, study limitations, and potential confounding factors. We acknowledge that most studies published should be viewed as hypothesis-generating, rather than conclusive."

The original paper Contradicted and Initially Stronger Effects in Highly Cited Clinical Research, appeared in the Journal of the American Medical Association in July 2005. and is available on line for subscribers. The abstract is available on-line.

A related Guardian (September 8, 2005) article is Don't dumb me down. It states:

- Statistics are what causes the most fear for reporters, and so they are usually just edited out, with interesting consequences. Because science isn't about something being true or not true: that's a humanities graduate parody. It's about the error bar, statistical significance, it's about how reliable and valid the experiment was, it's about coming to a verdict, about a hypothesis, on the back of lots of bits of evidence.

In fact, the Guardian has a web page with weekly articles devoted to bad science. You are invited to make submissions. "If you are a purveyor of bad science, be afraid. If you are on the side, of light and good, be vigilant: and for the love of Karl Popper, email me every last instance you find of this evil. Only by working joyously together can we free this beautiful, complex world from such a vile scourge."

Discussion

Dr Ioannidis's study focuses on medical research only. Would the same conclusions be applicable to other sciences such as physics or is there an inherent bias in his research?

The Economist article finishes by asking, "Is there a less than even chance that Dr. Ioannidis's paper is itself wrong?"

Submitted by John Gavin.

Paulos on errors in medical studies

Why medical studies are often wrong; John Allen Paulos explains how bad math haunts heath research

Who's Counting, ABCNews.com, 7 August 2005

In this installment of his online column, Paulos considers the JAMA report about contradictions in health research (Ioannidis, J.P.A. Contradicted and initially stronger effects in highly cited clinical research. JAMA, July14, 2005; 294:218-228 ). This research is well described above.

In the present article, Paulos cites a number of reasons for the problems. A single study is rarely definitive, but headlines and soundbites usually don't wait for scientific consensus to develop. People fail to appreciate differences in quality of research. Experiments are stronger than observational studies; in particular, surveys that depend on patients' self-reporting of lifestyle habits can obviously be unreliable. These ideas echo points made by the medical journals themselves in response to news reports (see, for example, see this Associated Press report).

Paulos also describes some conflicting psychological responses to medical news. People can be overly eager to believe that a new treatment will work. On the other side of the coin, in what he calls the "tyranny of the anecdote," people also overreact to stories of negative side-effects, even though such incidents may be isolated.

DISCUSSION QUESTION:

On the last point, Paulos writes:

A distinction from statistics is marginally relevant. We're said to commit a Type I error when we reject a truth and a Type II error when we accept a falsehood. In listening to news reports people often have an inclination to suspend their initial disbelief in order to be cheered and thereby risk making a Type II error. In evaluating medical claims, however, researchers generally have an opposite inclination to suspend their initial belief in order not to be beguiled and thereby risk making a Type I error.

Do you understand the distinction being drawn? To what hypotheses does this discussion refer?

Poor people receive worst public services

In the UK, it seems that the poorer you are the less likely you are to have access to public services, such as health care. This counter intuitive result is known as the "inverse care law" - those in greatest need have the worst services. A new set of reports from the Joseph Rowntree Foundation (JRF) sets out to graphically illustrate the nature and extent of geographical and social inequality in the UK at the beginning of the twenty-first century.

This study addresses inequalities using data from the 2001 Census, such as the geographical relationship between poverty, affluence and area. Appropriate Census data were extracted from the Census database and their distribution explored using maps, graphs and charts.

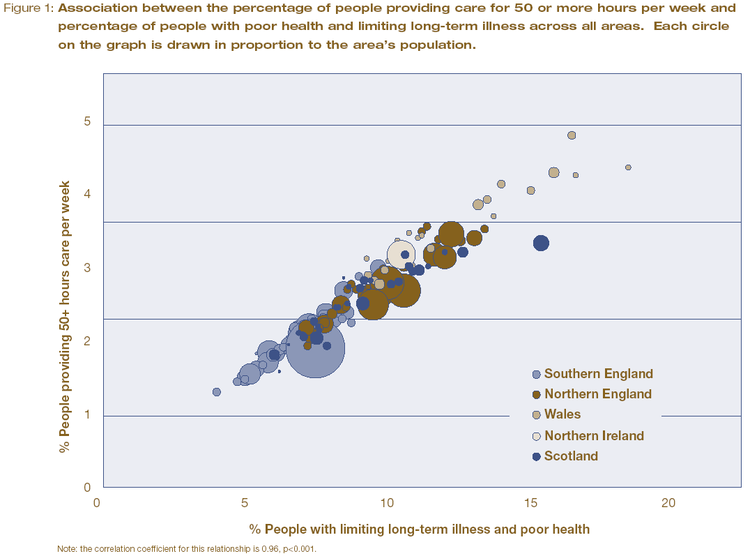

For example, 4.5 million people in the UK reported that they had both poor health and a limiting long-term illness in 2001. 5.9 million people said they provide care to family and friends on an informal basis. The amount of this informal care is provided in direct proportion to the rate of poor health in areas across the UK. The authors use a carefully constructed graph, based on census data, to illustrate the strong relationship between the two social variables.

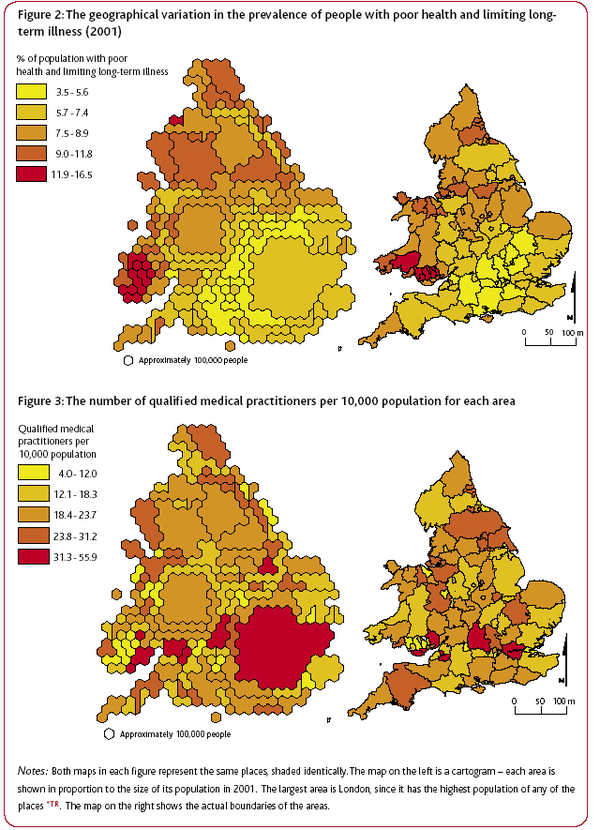

Another report, Life in Britain, provided a geographical graph of the ‘inverse care law’. The authors use geographic data from the 2001 cencus to highlight that higher numbers of practising, qualified medical practitioners tend to live and work in areas where the rates of illness are lower.

In both figures, the cartograms on the left shows each area in proportion to its population in 2001. The largest area is London, as it has the highest population density. The right hand map shows the actual boundaries of the areas.

The authors comment on the graph that "perversely, people living in the poorest neighbourhoods with the greatest needs are often the least likely to have access to the services and support that would help them improve their lives." Given these results, the authors are not surprisingly very negative on their views of social equality in the UK today. Prof. Dorling said "it is acutely disappointing to discover that so many opportunities and resources still depend on where people live." And Dr Ben Wheeler, also from the University of Sheffield, said that "the census data shows quite clearly that although living standards have increased in 60 years, the rich and poor in Britain continue to live in two different worlds."

These graphs demonstrates the power of the Census to provide easily interpreted data that consider the entire population and make obvious the continued unequal distribution of resources and prospects in the UK today.

The authors advocate the use of simple quantitative methods throughout their work, the most complex being correlation coefficients. Typically, they use pairs of variables, derived from the Census data, are compared across the geographical areas, with most pairs representing one measure of need and one measure of availability. The objective is demonstrates associations rather than proving causes.

A related ‘inverse education law’ also appears to exist in the case of education. Areas which have the highest proportions of young people with no qualifications tend to have the fewest teachers available.

Further reading

Guardian Unlimited,

Matt Weaver, September 1, 2005.

JRF report: poverty, affluence and area (pdf file), Dr Ben Wheeler and Professor Danny Dorling from the University of Sheffield, Dr Mary Shaw from the University of Bristol and Dr Richard Mitchell from the University of Edinburgh.

Life in Britain

JRF report: Life in Britain A pack summarising the results of the analysis of the UK 2001 Census data was published by The Policy Press. It is intended for use by students, their teachers and a wide range of practitioners and policy makers, and consists of 10 short reports, a summary, a technical report and 5 A2 posters.

Some parts of some Joseph Rowntree Foundation reports are available on-line and are well worth reading. For example, Thomas Clarkson won a prize in 1785, while he was a student at Cambridge, for An essay on the impolicy of the African slave trade. His essay includes an analysis of the very high rates of mortality (20%) among seamen on board eighty-eight slave ships that returned to Liverpool from their respective voyages in September 1787. This analysis was intended to counter the then prevalent pro-slavery argument that slave trade provided a nusery for British seamen. He includes some chilling graphics on life for slaves on board as well. This essay provoked him to pursue the goal of the abolition of slavery. This link also provides an harrowing extract from his book, History of the abolition of the African slave trade, which was first published in 1817, in which he gives more details of conditions of the lives of slaves.

Discussion

Do you think that a lack of doctors lead to areas with generally poor health, or are areas with generally poor health unattractive places for doctors for they live, causing them to relocate elsewhere?

Submitted by John Gavin.

Statistics could have spotted mass murderer

NewScientist.com news service,

John Pickrell, 06 September 2005.

Plotting death

Emma Young, New Scientist, 09 February 2001.

In 2000 Harold Shipman, a UK family doctor, was convicted of murdering 15 patients. Statistical quality-control methods might have allowed authorities to catch Shipman much sooner, according to a new study. David Spiegelhalter of the UK Medical Research Council's Biostatistics Unit, Cambridge, UK, has applied an industrial quality-control technique to data on the death of Shipman's patients to see if his heinous crimes could have been detected any earlier. "The method was first used in 1943 to ensure consistent quality in explosive shells and other wartime munitions production lines", says Spiegelhalter. The same statistics are used today in a wide range of industries, but have never before been applied to healthcare performance.

These methods on their own are not enough but cross-referencing other factors such as time of death or location might have set alarm bells ringing – many of Shipman's victims were murdered at around 3pm, during his afternoon rounds, and anomalous numbers died while in Shipman’s presence. "Maths has many crime-fighting applications," comments applied mathematician Chris Budd at the University of Bath, UK. "Statistics can be a useful approach for detecting anomalies in many contexts," he says.

The control-chart graphical method was developed by US physicist Walter Shewhart for use in the manufacturing industry. Scores are not ranked into a league table. Instead, the number of adverse outcomes is plotted against the total number of cases on a graph. A line is drawn through the mean, and all scores within three standard deviations (in practice, most of the scores) are considered to be down to inherent variation in the system. Any scores outside the 'control limits' suggest a special cause. "This tells you where the real problems in a system are," Tom Marshall, of the University of Birmingham, told New Scientist. "In a league table, someone has to be at the top and someone has to be at the bottom, but that doesn't necessarily mean any kind of intervention should be taken."

However, Spiegelhalter believes his method is more powerful as it allows data from multiple years to be assessed

Self Experimentation

Does the Truth Lie Within? The New York Times, September 11, 2005 Stephen J. Dubner and Steven D. Levitt

Another article in the New York Times by the authors of Freakonomics discusses self experimentation. The authors highlight the work of Seth Roberts:

Seth Roberts is a 52-year-old psychology professor at the University of California at Berkeley. If you knew Roberts 25 years ago, you might remember him as a man with problems. He had acne, and most days he woke up too early, which left him exhausted. He wasn't depressed, but he wasn't always in the best of moods. Most troubling to Roberts, he was overweight: at 5-foot-11, he weighed 200 pounds.

When you encounter Seth Roberts today, he is a clear-skinned, well-rested, entirely affable man who weighs about 160 pounds and looks 10 years younger than his age. How did this happen?

The authors go on to say that all of Seth Roberts ills were cured by self experimentation. He tried various interventions and evaluated the results.

It took him more than 10 years of experimenting, but he found that his morning insomnia could be cured if, on the previous day, he got lots of morning light, skipped breakfast and spent at least eight hours standing.

Losing weight depended on a theory of weight regulation known as the set-point theory which says that your weight is determined by what you needed to survive during stone age times because

when food is scarcer, you become less hungry; and you get hungrier when there's a lot of food around.

This encouraged us to store food when it was plentiful as fat so as to help us survive when food becomes scarce. It worked well long ago, but today food is plentiful all year round, so the signal to stop storing fat never gets turned off. Seth Roberts experimented with flavors that might trick the set-point system into thinking that food was actually scarce. A bland, unflavorful diet might work, he theorized, but no one wants to be stuck eating like that. He found that a few tablespoons of unflavored oil worked as did several ounces of sugar water.

The results were astounding. Roberts lost 40 pounds and never gained it back. He could eat pretty much whenever and whatever he wanted, but he was far less hungry than he had ever been. Friends and colleagues tried his diet, usually with similar results.

These self experiments are a special case of the "N of 1 trials." A good example of this type of trial appears in the British Medical Journal: Jeffrey Mahon, Adreas Laupacis, Allan Donner, Thomas Wood. Randomised study of n of 1 trials versus standard practice. BMJ 1996; 312: 1069-1074 (27 April). Full free text The N of 1 trial is simply a crossover trial with a single patient.

Numerous references and additional details are at the Freakonomics website

There are several amusing examples of self experimentation at this website, but not mentioned is one of my personal favorites, the 1994 Ig Nobel prize winner in Entomology:

Robert A. Lopez of Westport, NY, valiant veterinarian and friend of all creatures great and small, for his series of experiments in obtaining ear mites from cats, inserting them into his own ear, and carefully observing and analyzing the results. [Published as "Of Mites and Man," The Journal of the American Veterinary Medical Association, vol. 203, no. 5, Sept. 1, 1993, pp. 606-7.]

Discussion

One potential source of bias in self experimentation is the inability to adequately blind the patient. What other sources of bias are there in this type of study?

Most research requires the informed consent of the research subject. Is informed consent an issue in self experimentation?

Submitted by Steve Simon